All Categories

Featured

Table of Contents

Passion will certainly be paid from the day of fatality to date of payment. If death is because of natural causes, fatality proceeds will certainly be the return of costs, and rate of interest on the premium paid will certainly go to an annual reliable price defined in the plan agreement. Disclosures This policy does not guarantee that its proceeds will certainly be enough to pay for any type of specific solution or merchandise at the time of need or that services or product will be supplied by any kind of particular company.

A full declaration of coverage is located only in the policy. For even more details on coverage, expenses, constraints; or to obtain protection, get in touch with a local State Ranch representative. There are constraints and conditions pertaining to payment of benefits due to misstatements on the application. funeral plan for over 80. Rewards are a return of premium and are based on the real death, expense, and financial investment experience of the Firm.

Permanent life insurance policy establishes cash worth that can be obtained. Plan lendings accrue interest and unsettled plan car loans and rate of interest will certainly decrease the survivor benefit and cash money value of the plan. The quantity of money worth readily available will usually rely on the kind of permanent plan bought, the quantity of insurance coverage bought, the length of time the plan has actually been in pressure and any impressive plan car loans.

Connect links for the items on this web page are from companions that compensate us (see our advertiser disclosure with our list of partners for more information). Our point of views are our own. See exactly how we rank life insurance coverage products to compose objective item testimonials. Interment insurance is a life insurance policy policy that covers end-of-life costs.

Burial insurance coverage calls for no medical exam, making it accessible to those with clinical conditions. The loss of a loved one is psychological and stressful. Making funeral prep work and discovering a method to pay for them while regreting adds another layer of anxiety. This is where having burial insurance, also called last expense insurance coverage, is available in useful.

Streamlined problem life insurance policy needs a health and wellness assessment. If your wellness standing invalidates you from typical life insurance, burial insurance may be an alternative. Along with less health and wellness test demands, interment insurance coverage has a fast turn-around time for authorizations. You can obtain coverage within days and even the same day you apply.

Oxford Life Final Expense Rates

, interment insurance comes in numerous forms. This plan is best for those with light to moderate health and wellness problems, like high blood pressure, diabetes, or asthma. If you don't desire a medical exam however can certify for a streamlined problem policy, it is typically a much better deal than a guaranteed issue policy because you can obtain more protection for a more affordable costs.

Pre-need insurance policy is high-risk due to the fact that the recipient is the funeral chapel and insurance coverage specifies to the selected funeral chapel. Must the funeral chapel fail or you relocate out of state, you may not have protection, which beats the objective of pre-planning. In addition, according to the AARP, the Funeral Service Consumers Partnership (FCA) discourages acquiring pre-need.

Those are basically interment insurance coverage plans. For guaranteed life insurance policy, premium computations depend on your age, gender, where you live, and insurance coverage quantity.

Expense Coverage

Interment insurance coverage provides a simplified application for end-of-life protection. Most insurer need you to talk to an insurance representative to request a policy and acquire a quote. The insurance agents will certainly request for your individual details, get in touch with information, financial information, and coverage choices. If you make a decision to purchase an ensured issue life policy, you will not need to undertake a clinical examination or survey - life insurance burial plan.

The objective of living insurance is to relieve the problem on your enjoyed ones after your loss. If you have an extra funeral policy, your loved ones can utilize the funeral policy to take care of final expenditures and get an instant disbursement from your life insurance policy to deal with the mortgage and education prices.

Individuals who are middle-aged or older with medical conditions might consider interment insurance, as they may not get approved for standard policies with more stringent approval criteria. Furthermore, burial insurance can be useful to those without comprehensive cost savings or traditional life insurance coverage. life burial insurance quote. Burial insurance coverage varies from other kinds of insurance coverage in that it offers a lower survivor benefit, typically just adequate to cover expenditures for a funeral and other linked prices

ExperienceAlani is a previous insurance other on the Personal Financing Expert team. She's assessed life insurance coverage and pet insurance firms and has actually written various explainers on travel insurance policy, credit, debt, and home insurance coverage.

Real Insurance Funeral Cover

The more coverage you obtain, the greater your premium will certainly be. Last expense life insurance has a variety of advantages. Specifically, everyone who applies can obtain approved, which is not the case with various other types of life insurance. Final expenditure insurance policy is frequently recommended for elders who may not get approved for traditional life insurance coverage as a result of their age.

Additionally, final expenditure insurance is advantageous for people that intend to pay for their own funeral. Burial and cremation services can be expensive, so last expense insurance policy offers satisfaction knowing that your loved ones will not need to utilize their financial savings to pay for your end-of-life plans. Last cost coverage is not the finest product for everybody.

Obtaining whole life insurance coverage through Principles is fast and simple. Insurance coverage is available for elders in between the ages of 66-85, and there's no clinical exam needed.

Based on your responses, you'll see your approximated rate and the quantity of insurance coverage you certify for (between $1,000-$ 30,000). You can buy a plan online, and your coverage begins instantly after paying the first premium. Your rate never ever alters, and you are covered for your whole life time, if you continue making the monthly settlements.

Final Expense Direct Insurance

Last expenditure insurance coverage uses benefits yet requires careful factor to consider to establish if it's appropriate for you. Life insurance policy can resolve a range of monetary needs. Life insurance for last expenses is a type of long-term life insurance policy designed to cover expenses that arise at the end of life - insurance for burial expenses. These plans are relatively simple to get, making them suitable for older people or those who have wellness concerns.

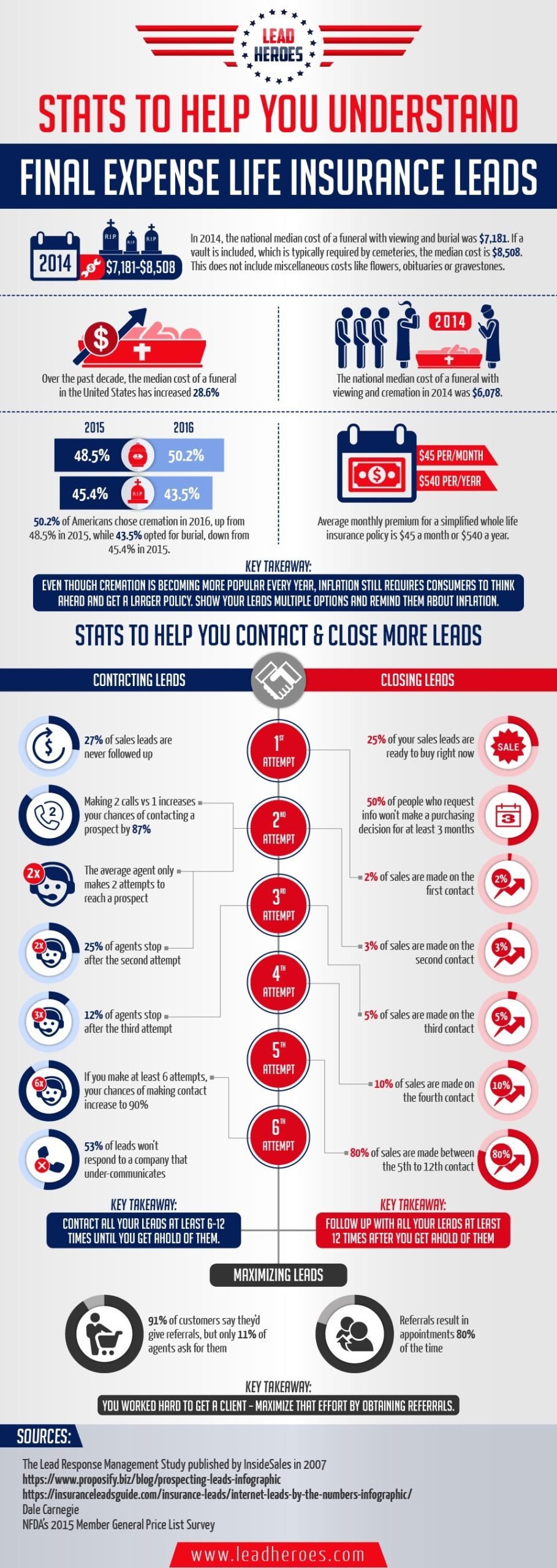

According to the National Funeral Supervisors Organization, the average expense of a funeral service with interment and a watching is $7,848.1 Your liked ones may not have access to that much money after your fatality, which can contribute to the anxiety they experience. Furthermore, they may run into other costs connected to your passing away.

Last expenditure coverage is in some cases called interment insurance coverage, however the money can pay for essentially anything your loved ones need. Recipients can make use of the death benefit for anything they require, allowing them to deal with the most important monetary priorities.

: Work with specialists to help with handling the estate and browsing the probate process.: Shut out make up any kind of end-of-life therapy or care.: Pay off any type of other financial debts, including auto financings and credit rating cards.: Recipients have complete discretion to use the funds for anything they require. The money could even be made use of to create a heritage for education expenses or contributed to charity.

Table of Contents

Latest Posts

The Best Funeral Cover

Funeral Plan Company

Select Advisor Funeral Insurance Plan

More

Latest Posts

The Best Funeral Cover

Funeral Plan Company

Select Advisor Funeral Insurance Plan